Overview of Section 8 Company Registration

An NGO can be listed as a Section 8 company following the Companies Act 2013 or as a trust supporting the Trust Act 1882 or as a society under the ‘Societies Act 1860’. Section 8 Company Registration is the method of incorporation of an NGO under the ‘Companies Act 2013’. Any company under section 8 can be registered for promoting ‘Art’, ‘Science’, ‘Commerce’, ‘Technology’, ‘Sports’, ‘Education’, ‘Social Research’, ‘Social Welfare’, ‘Religion’, ‘Charity’ and ‘Protection of Environment’ etc.

Latest Incorporation of Section 8 Companies as per Companies Act 2013- Sixth Amendment 2019

MCA consult companies (Incorporation) 6th Amendment Rules, 2019 dated 7th June, 2019 has revised the incorporation norms for incorporating Section 8 Companies. The rule has come into effect from August 15, 2019.

Subsequently, the new rule has made license and registration process for Section 8 Companies easy. Now applicants can apply for the registration of Section 8 Companies via filling a single application in Form SPICe. MCA website has provided the following instructions that will clear the air of doubt:

- Pending Form INC-12 SRNs for new Companies pending on the part of respective RoCs will be considered as ‘Rejected’ on 15th August 2019. Such applicants can directly file SPICe for the purpose of receiving License Number and for forming Section 8 Companies.

- Shareholders who already owns a license number and are waiting to file SPICe form so that they can incorporate Section 8 Companies should note that the forms shall be processed once the certain time lag is allowed for work flow changes to take effect.

- Those shareholders who are done with the filling of SPICe forms but are pending on the part of CRC may have to wait for the processing of these forms once the work flow change comes into action.

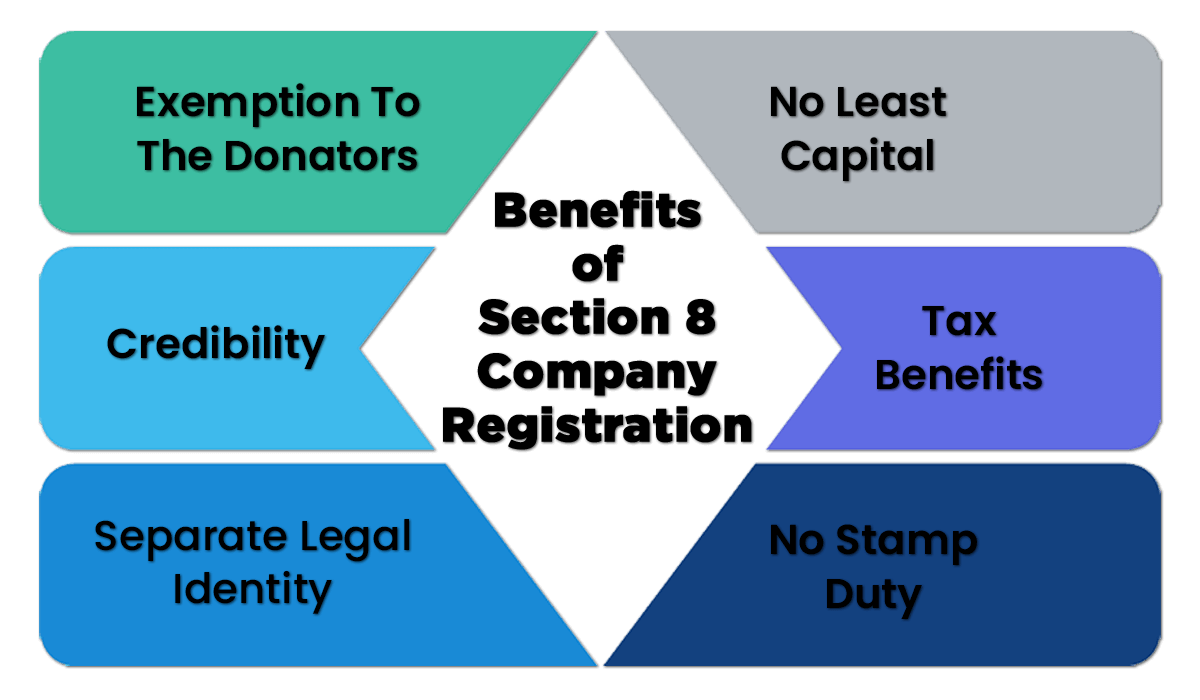

Benefits of Section 8 Company Registration

Comprising a Non-profit Organization does not indicate that the Company cannot secure a profit or commission. It only implies that the Company can earn income, but the promoters are not to benefit from those profits. Numerous Tax exemptions are also there for such companies. Even the donors providing towards Section 8 Company have the option to claim the Tax Exemption against these donations. Some perks of them are as given below:

- No Least CapitalThere is no minimum capital necessary for a Section 8 Company Registration within India.

- Tax BenefitsThere are many tax compensations under the Section 8 Company Registration in India.

- No Stamp DutyNo stamp duty is required on the incorporation of Section 8 Company in India as it is facing the provision of the instalment of stamp duty on the MoA and AoA of the private limited Business.

- Separate Legal IdentitySection 8 Company certification has a separate legal entity. It takes a distinct legal personality from its legs and arms.

- CredibilitySection 8 Company has more reliability than any other form of a philanthropic/charitable organization.

- Exemption To The DonatorsUnder Section 80G, the exclusion is awarded to the donators if the section 8 company is registered under section 80G.

Documents Required for Section 8 Company Registration

- PAN Card of all the Members

- Aadhaar Card of all the Members

- Latest Bank Statement of all the Members and the Company

- Telephone Bill/Electricity Bill

- Voter ID

- Passport

- Driving license

- Passport size photograph of all the members

- Copy of the Rental agreement

Eligibility Criteria for Section 8 Company Registration

- A Person or HUF or limited Company is qualified to start a Section- 8 company registration inside India.

- Two or more person who will act as a shareholder or director of the Company should fulfil all the conditions of the Section 8 Company registration.

- At least one of the directors shall be a resident of India.

- The intention should be the advancement of sports, social welfare, the progress of science and art, education and financial support to lower-income societies.

- The surplus created must be used for reaching the principal purpose of section 8 company solely.

- Any of the members of the Company cannot draw any compensation in any form of cash or kind.

- No profit should be shared among the members and director of the Association directly or indirectly

- The Company should have a distinct vision and outline plan for the next three years.

- Property Management: The ownership of the property lies in the name of the Company, and it can only be sold as per the rules mentioned under the Companies Act. (Ex: With the consent of the Board of Directors in the form of a resolution).

- Yearly filing of accounts, reports and the returns of the Association with the ROC is required to meet the compliance required.

All the Administrators must have their valid DIN (Director’s Identification Number) & DSC (Digital Signature Certificate)

Lists valuing Number of Directors in a Section 8 Company Registration

- Section 149(1) Of The ‘Companies Act 2013’directed least of 3 & 2 directors for public limited and private limited company sequentially and a maximum of 15 directors. Although there is no minimum or maximum prescript for section 8 companies.

- The Second Proviso To Section 149(1) guides a woman director in a designated class of companies.

- Section 149(3) Of The Companies Act 2013 commands resident director in each company.

- Section 165 Of The Companies Act, 2013 Directorship in Section 8 Companies will not get summed up during the total number of directorships gets measured, i.e. it will not be adding while adhering to the maximum limit of twenty Directorship as prescribed in the Act.

- Sections 149(1) Of The ‘Companies Act, 2013’ Section 8 Companies Are not below an obligation to appoint an independent director and are free of all the essential provisions involved with Autonomous directors.

- Under Section 149(3) Section 8 company necessity have a minimum of one Resident Director, i.e. a leader who has resided in India at least for a total duration of 182 days (one hundred and eighty-two days) or more in the previous table year

Section 8 Company Registration Procedure

In respect to simplifying the process of incorporating Section 8 section companies on 7th June 2019 requirement of prior filling of INC-12 has been dispensed vide the Companies (Incorporation) Sixth Amendment Rules,2019.

- Application for Name Availability in the SPICe+ FormApply for name availability through SPICe+ form facility. It is necessary for Section 8 Company to have words like Foundation, Forum, Association, Federation, Chambers, Confederation, Council, Electoral Trust, in its name.

Applicant can give two names at a time and can perform only one resubmission in the SPICe+ form.

- Preparation of MOA and AOAMemorandum of association works as a charter of the company and clears the realm of company’s activity. While an article of association of the company tells about the internal management of the company.

Use Form INC-13 to file MOA of a Section 8 Company, also, there is no prescribed format is mentioned for AOA of a Section 8 Company.

Each subscriber has to sign the memorandum and article of association who shall also needs to provide his name, address, description, and occupation, if any, in the presence of minimum one witness who will affirm the signature and will happen to sign and add his name, address, description, and occupation.

- Filling of SPICe+ FormOnce you have obtained Central Government approval it’s time for you to move a step ahead and file form SPICEe+.